Select Language

S&P Upgrades India’s GDP Forecast Despite Global Geopolitical Risks

Despite global economic fragility, India’s economy remains resilient, with S&P Global Ratings revising its GDP growth forecast upward to 6.5% for FY26. Factors like a normal monsoon, lower crude oil prices, and monetary easing contribute to this optimistic outlook.

Why S&P is Bullish on India’s Economy

1. Strong Domestic Demand Driving Growth

Unlike export-dependent economies, India’s growth is largely fueled by robust domestic consumption. S&P highlights that countries with lower reliance on goods exports, like India, are better positioned to withstand global slowdowns.

2. Normal Monsoon Expected

A good monsoon is crucial for India’s agricultural sector, which supports rural incomes and consumption. S&P’s forecast assumes normal rainfall, boosting farm output and overall economic activity.

3. Lower Crude Oil Prices Easing Inflation

Since India imports nearly 90% of its crude oil, falling global oil prices help reduce inflationary pressures. This allows the Reserve Bank of India (RBI) to maintain a more accommodative monetary policy.

4. Income Tax Concessions & Monetary Easing

Government policies, including tax relief measures and RBI’s potential rate cuts, are expected to stimulate spending and investment, further supporting GDP growth.

5. Alignment with RBI’s Projections

S&P’s 6.5% growth forecast matches the RBI’s recent estimate, reinforcing confidence in India’s economic trajectory.

Global Challenges & Risks

While India’s outlook is positive, global uncertainties persist:

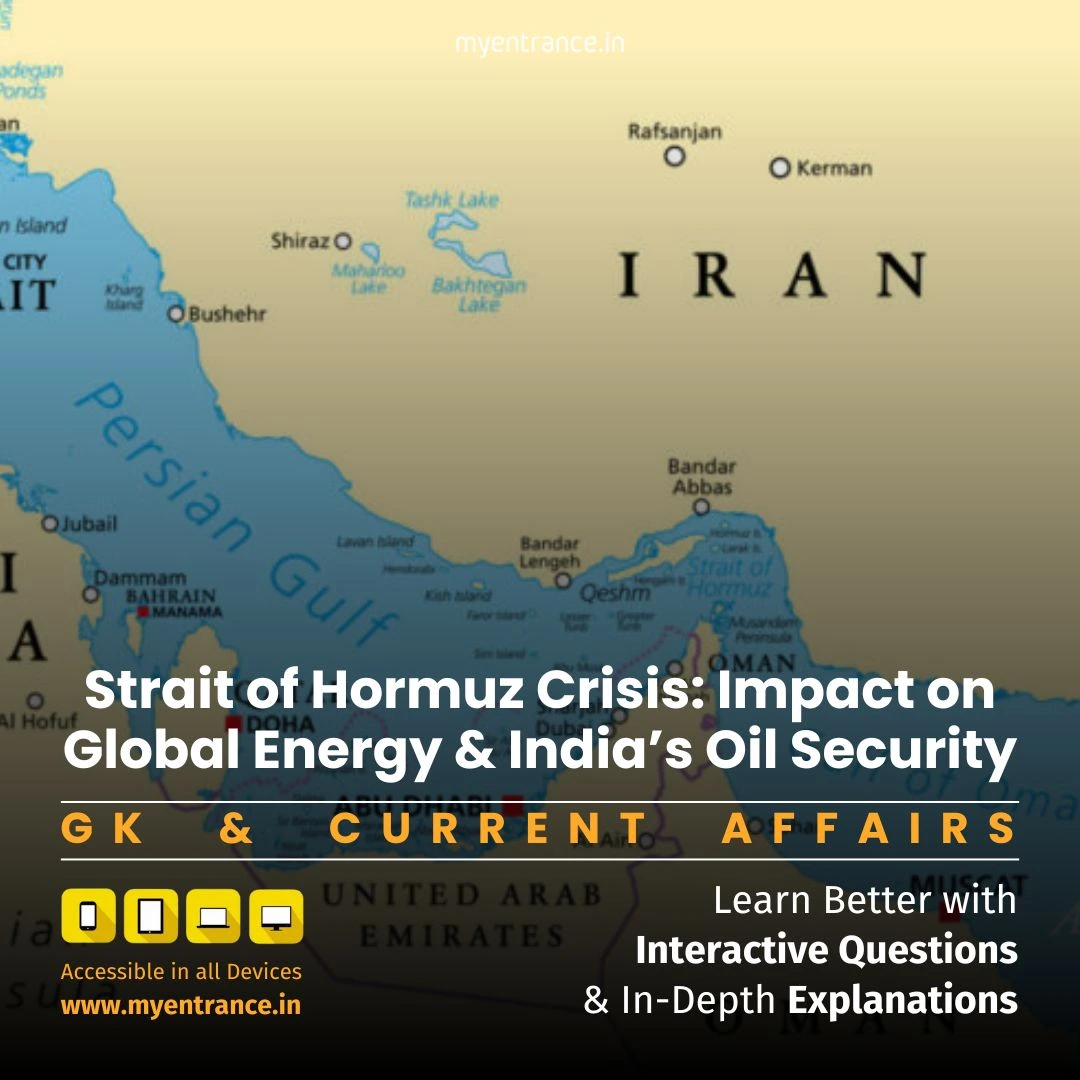

Geopolitical tensions in the Middle East could disrupt oil supplies, impacting energy-importing nations like India.

US tariff policies under President Trump may slow global trade and investments.

Sustained high oil prices could strain India’s current account deficit and inflation.

However, S&P notes that well-supplied global energy markets may prevent long-term oil price shocks.

Sample Questions & Answers for Competitive Exams

Q1: Why has S&P revised India’s GDP growth forecast upward to 6.5%?

Ans: S&P cites strong domestic demand, expected normal monsoon, lower crude oil prices, and monetary easing as key reasons for the upgrade.

Q2: How does a normal monsoon benefit India’s economy?

Ans: A good monsoon boosts agricultural output, increases rural incomes, and supports overall consumption-driven economic growth.

Q3: What percentage of India’s crude oil is imported?

Ans: India imports around 90% of its crude oil requirements, making it sensitive to global oil price fluctuations.

Q4: How do US tariff policies affect India’s economy?

Ans: Higher US import duties create global trade uncertainty, potentially slowing investments and economic expansion worldwide, including in India.

Q5: What is RBI’s GDP growth forecast for FY26?

Ans: The Reserve Bank of India (RBI) also projects a 6.5% GDP growth for FY26, aligning with S&P’s latest estimate.

Most Predicted Questions

Comprehensive study materials, Expert-guided tips & tricks, Mock tests and instant results.

Start your SSC, NIFT, NID, FDDI, PSC journey today with MyEntrance, your ultimate online coaching platform.