Select Language

How Hormuz Closure Could Reshape Energy Flows & India’s Fuel Prices

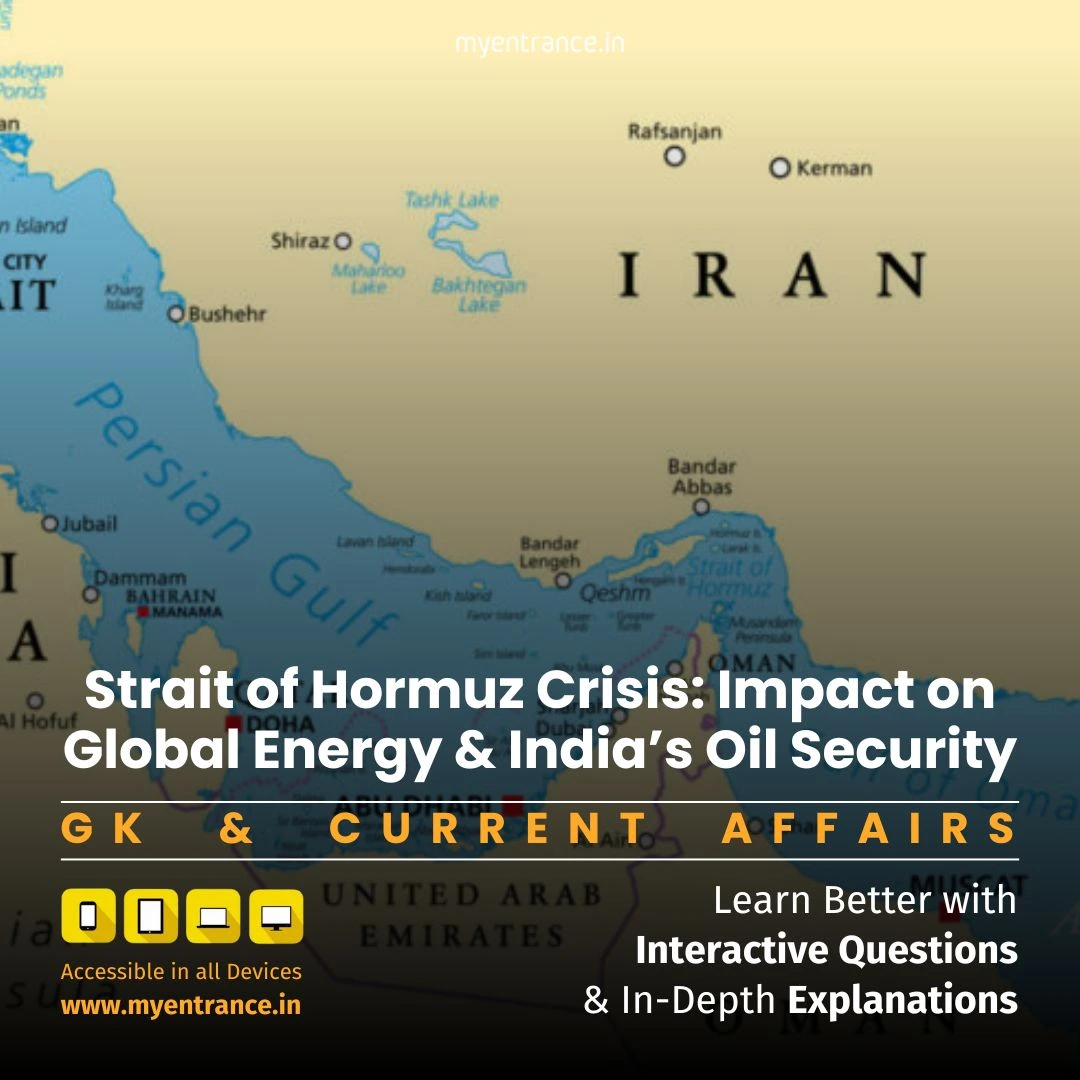

Iran’s parliament has demanded closure of the Strait of Hormuz after US attacks, risking global energy chaos. For India – reliant on West Asian oil via Hormuz – this could trigger fuel price surges and supply shocks.

Why the Strait of Hormuz Matters

The Strait of Hormuz, a narrow channel between Iran and Oman, links the Persian Gulf with global oceans. As the world’s most critical oil chokepoint, 20% of global oil consumption and 30% of LNG trade passes through it. For India, this route is irreplaceable: over 60% of our oil imports from Iraq, Saudi Arabia, UAE, and Qatar traverse these waters.

India’s Energy Security at Risk

Import Dependency: India imports 85% of its crude oil and 50% of LNG needs. Any Hormuz blockade could disrupt two-thirds of our oil supply.

Price Vulnerability: Past threats (like 2019 tanker attacks) spiked oil prices by 15%. Current tensions already inflate shipping insurance costs.

Limited Alternatives: Russian oil (now India’s top source) avoids Hormuz, but West Asian suppliers lack viable rerouting options.

Global and Economic Fallout

Oil Price Surge: Analysts warn prices could exceed $120/barrel if Hormuz closes, worsening India’s trade deficit and inflation.

Supply Chain Chaos: Higher freight costs and rerouted tankers would delay deliveries to Indian refineries.

Diplomatic Tightrope: India must balance ties with Iran (Chabahar port partner) and US-led maritime security coalitions.

International Law Context

The UN Convention on the Law of the Sea (UNCLOS) guarantees transit passage through straits like Hormuz. Iran’s closure would violate international law, inviting naval intervention.

Key Takeaways for Aspirants

Hormuz disruptions amplify India’s energy insecurity – a core GS Paper III (Economy) and GS II (International Relations) topic.

Conflict-driven oil spikes could derail India’s inflation management and fiscal planning.

Diversifying energy sources (e.g., Russian oil, green hydrogen) remains critical for long-term security.

Sample Q&A (UPSC Style)

Q1: How does the Strait of Hormuz impact India’s energy security?

A1: It transports ~60% of India’s oil imports from Iraq, Saudi Arabia, and Qatar. Closure could disrupt supply chains, spike prices, and widen India’s current account deficit.

Q2: Which international law governs navigation rights in the Strait of Hormuz?

A2: UNCLOS (UN Convention on the Law of the Sea) mandates unimpeded transit passage through international straits.

Q3: Why hasn’t Iran previously closed Hormuz despite threats?

A3: Closure would violate international law, provoke military retaliation, and cripple Iran’s own oil exports.

Q4: How could Hormuz disruption affect India’s economy?

*A4: Fuel price hikes would raise inflation, increase subsidy burdens, weaken the rupee, and reduce GDP growth by 0.5-1% (IMF estimates).*

Q5: Name India’s top crude suppliers if West Asian routes are blocked.

A5: Russia (35% of imports), followed by the US and Africa – though at higher costs and logistical challenges.

Most Predicted Questions

Comprehensive study materials, Expert-guided tips & tricks, Mock tests and instant results.

Start your SSC, NIFT, NID, FDDI, PSC journey today with MyEntrance, your ultimate online coaching platform.