Select Language

₹1 Lakh Crore Urban Challenge Fund: A Must-Know Topic for Competitive Exams

The Urban Challenge Fund, unveiled in Budget 2025, marks a significant push toward reshaping India’s urban future. With a massive ₹1 Lakh Crore allocation, the initiative aims to modernize city infrastructure, boost economic productivity, and attract private investment. For aspirants preparing for SSC, PSC, UPSC, and similar exams, understanding this fund is crucial for scoring well in current affairs and governance-related questions.

Why This Matters for Competitive Exam Preparation

Urban development and governance topics are crucial for aspirants of SSC, PSC, UPSC, and other exams. These schemes often appear in:

Preliminary MCQs

Mains descriptive answers

Essay writing and group discussions

Understanding how schemes like the Urban Challenge Fund (UCF) reshape India’s urban landscape gives you an edge in both objective and analytical sections.

In the News: What is the Urban Challenge Fund (UCF)?

The Finance Minister announced a ₹1 Lakh Crore Urban Challenge Fund in Budget 2025-26. This massive investment is designed to:

Transform cities into economic growth hubs

Enable creative redevelopment of old, congested urban areas

Upgrade water supply and sanitation systems

This initiative is built to encourage private sector participation and reduce reliance on government funding through innovative financing models.

Urban Challenge Fund – Key Highlights for Exams

Main Features:

Total Outlay: ₹1 Lakh Crore

First-Year Allocation: ₹10,000 Crore (2025-26)

Government Share: 25% of each project’s cost

Funding Breakdown:

50% from bonds, loans, or PPPs

25% from the Urban Challenge Fund

25% from city or state governments

Important Comparison:

Unlike the 2023 Urban Infrastructure Development Fund (UIDF) which relied mainly on state-backed loans, UCF emphasizes market-linked financing like municipal bonds and public-private partnerships (PPPs).

Why Indian Cities Need the UCF – A Snapshot

Urban challenges that make the UCF necessary:

Funding Gaps: Municipal revenues account for only 0.6% of India’s GDP (RBI 2024)

Overcrowding Issues: Over half the population in metro cities like Delhi and Mumbai lives in slums

Low Private Participation: Just 5% of urban infrastructure is funded privately

Water & Sanitation Breakdown: Cities are battling daily service-level failures

Definitions to Know:

Statutory Town: Has a notified municipal body (e.g., BMC in Mumbai)

Census Town: Meets criteria like population over 5,000, non-agricultural workforce >75%, and density >400/km²

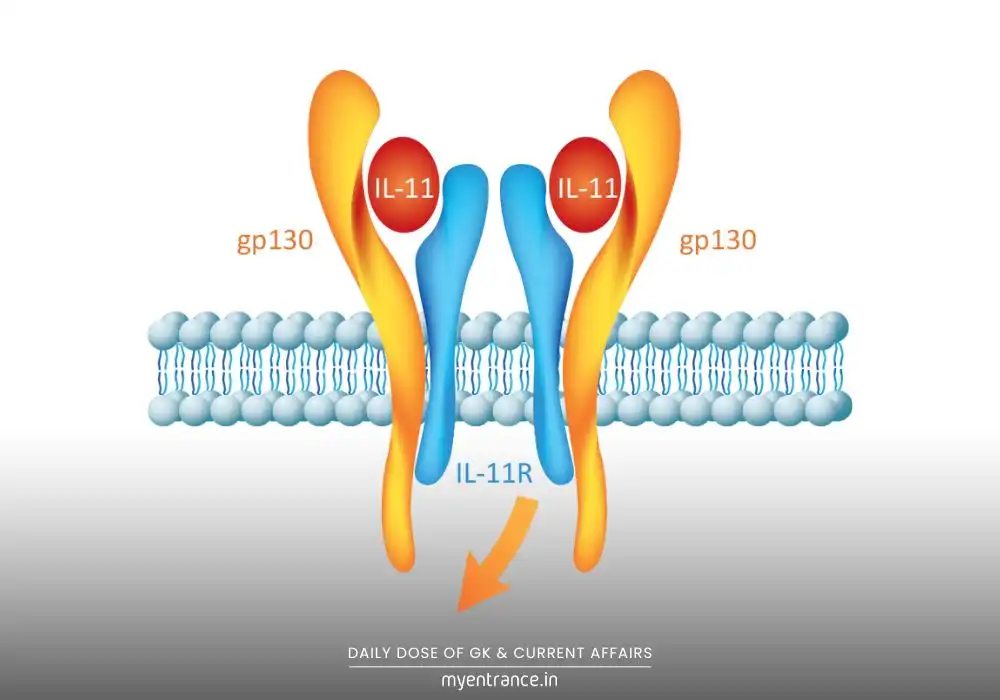

Municipal Bonds – The Financial Backbone of UCF

What Are Municipal Bonds?

These are debt securities issued by city governments to fund urban infrastructure. Citizens or institutions invest and get returns from project revenues.

Key Points for Exams:

SEBI Stats: ₹2,800 Cr raised through 17 municipal bonds since 2017

Historical Insight: Bengaluru’s ₹125 Cr bond in 1997 set the precedent

RBI Alert: 75% of city finances still depend on state/central aid, which is not sustainable

Exam-Oriented Insights: What Should You Focus On?

For Prelims:

UCF’s funding structure

Definitions of statutory and census towns

Features of municipal bonds

For Mains:

Discuss topics like:

“Can the UCF solve India’s urban financing puzzle?”

“Is creative redevelopment more viable than creating new cities?”

Interlinked Subjects:

SDG 11 (Sustainable Cities and Communities)

PPP Models in Infrastructure

Fiscal Federalism in Urban Development

Conclusion: Your Exam Prep Strategy

The Urban Challenge Fund is more than a budget announcement—it’s a transformational policy move that connects with many topics in your exam syllabus. Whether you’re tackling GS papers, essays, or objective questions, mastering this topic gives you a strategic advantage.

SSC Most Predicted Questions

Comprehensive study materials, Expert-guided tips & tricks, Mock tests and instant results.

All this for only ₹199! Start your SSC/ PSC journey today with MyEntrance, your ultimate online coaching platform.