Select Language

RBI’s FCI Unveiled: Ace Economy Sections of SSC, PSC & Government Exams!

Struggling with economy topics for SSC, PSC, or banking exams? This complete guide simplifies the RBI’s groundbreaking Financial Conditions Index (FCI)—your secret weapon for easy preparation. At MyEntrance, India’s best site for online exam prep, we turn complex current affairs into actionable insights!

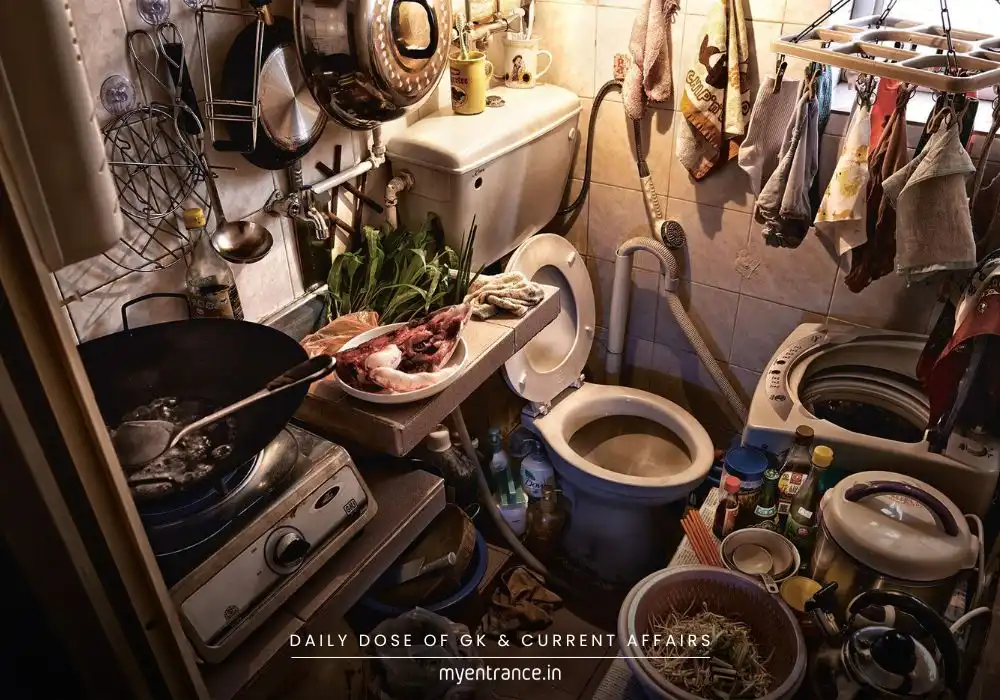

In a major move to track India’s financial health, the Reserve Bank of India (RBI) has proposed a daily Financial Conditions Index (FCI). This high-frequency tool aggregates real-time data from money markets, equities, forex, corporate bonds, and government securities (G-Secs).

Key Highlights:

What is FCI? A composite indicator measuring how “tight” (restrictive) or “easy” (supportive) financial conditions are daily, compared to historical averages since 2012.

Why It Matters: FCI helps policymakers and analysts detect market stress instantly—like liquidity crunches or equity surges—using 20+ financial indicators.

Impact on Economy:

Forex shifts, corporate bond yields, and G-Sec rates directly influence FCI’s readings.

A positive FCI value signals tighter conditions (e.g., rising borrowing costs), while negative values indicate easier access to funds.

Bigger Picture: FCI complements inflation data and GDP forecasts, offering a 360° view of macro-financial risks.

Recent Trends (2023–24):

Financial conditions eased mid-2023 but firmed up by late 2024. Currently, buoyant stock markets and high liquidity keep FCI favorable.

Did You Know?

The RBI, nationalized in 1949, aims to ensure “monetary stability” and “operate India’s credit system.” Its Mumbai-based office regulates currency, inflation, and growth policies.

Why This Matters for Exams

Topics like FCI dominate SSC, PSC, Banking, and UPSC exams under:

Current Affairs: FCI is a hot-button RBI initiative.

Economy Sections: Covers financial markets, monetary policy, and macroeconomic indicators (GS-III for UPSC Mains).

GK Updates: Questions on RBI’s roles, indices, and market tools are recurring.

Sample Exam Questions & Answers

Q: What does RBI’s Financial Conditions Index (FCI) measure?

A: Daily tightness/easiness of financial markets relative to historical averages.

Q: Which markets influence FCI?

A: Forex, equities, corporate bonds, G-Secs, and money markets.

Q: How does a positive FCI value impact the economy?

A: Signals tighter financial conditions (e.g., higher loan rates).

Q: When was RBI established?

A: April 1, 1935 (nationalized in 1949).

Q: What is RBI’s primary goal per its Preamble?

A: Ensure “monetary stability” and manage India’s currency/credit system.

Most Predicted Questions

Comprehensive study materials, Expert-guided tips & tricks, Mock tests and instant results.

Start your SSC, NIFT, NID, FDDI, PSC journey today with MyEntrance, your ultimate online coaching platform.