Translate Language

Is GST Coming for UPI Payments? Here’s What the Government Says

In a major relief for UPI users, the Finance Ministry has denied any plans to impose GST on transactions above ₹2000. This clarification comes after concerns were raised in Parliament regarding potential taxation on digital payments.

Is It True? Finance Ministry’s Official Response

Recent rumors suggested that the government was considering a GST levy on UPI transactions exceeding ₹2000. However, the Finance Ministry has officially denied these claims.

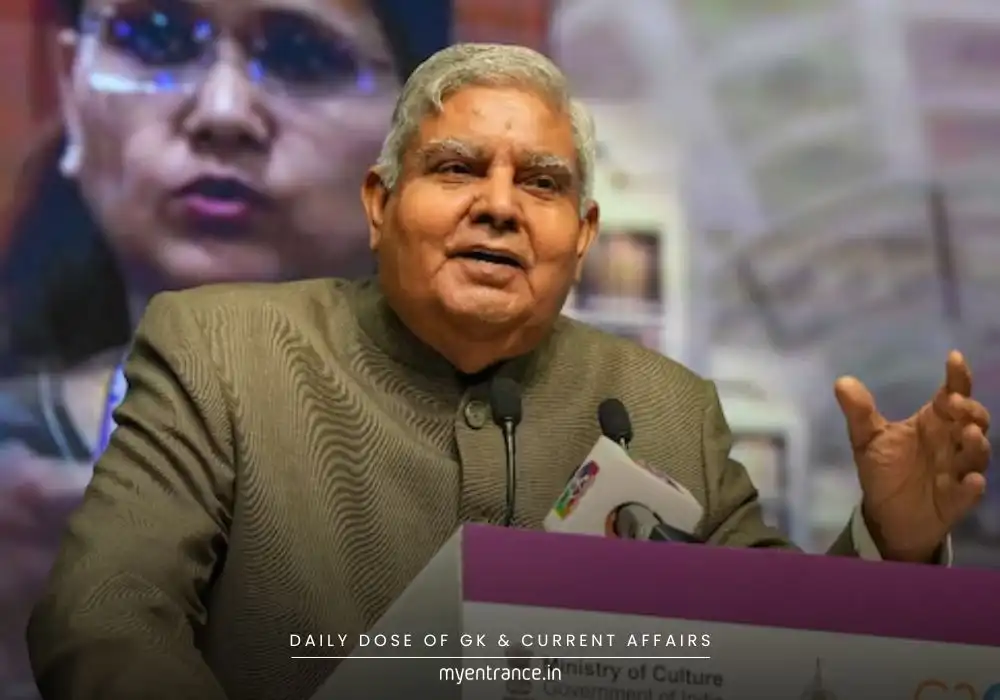

On July 22, 2024, Congress MP Anil Kumar Yadav raised this concern in the Rajya Sabha, asking whether the government was planning such a move and if public objections had been considered. Pankaj Chaudhary, Minister of State for Finance, responded clearly:

No such proposal exists before the government.

GST rates are decided by the GST Council, which includes representatives from both central and state governments.

No recommendation has been made by the GST Council to tax UPI transactions.

Why UPI Transactions Remain GST-Free

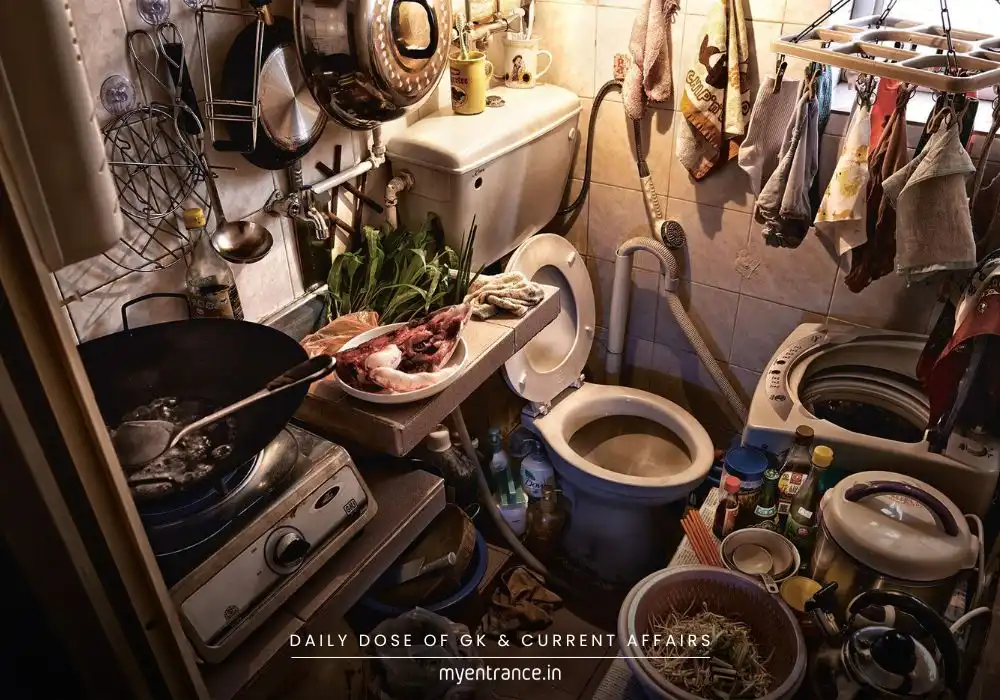

Currently, no Merchant Discount Rate (MDR) is applied to UPI payments, meaning there is no taxable component. The government has actively encouraged digital payments by:

Waiving MDR on UPI transactions since January 2020.

Introducing an Incentive Scheme (2021-22) to promote small-value UPI transactions, especially for merchants.

This ensures that digital payments remain affordable and accessible to all, supporting India’s push toward a cashless economy.

Questions & Answers (Helpful for Competitive Exams)

Q: Has the government proposed GST on UPI transactions above ₹2000?

A: No, the Finance Ministry has denied any such proposal.

Q: Which body decides GST rates in India?

A: The GST Council, a constitutional body with central and state representatives.

Q: What is MDR, and does it apply to UPI transactions?

A: MDR (Merchant Discount Rate) is a fee on digital payments, but it has been waived for UPI since 2020.

Q: What initiative supports small merchants using UPI?

A: The Incentive Scheme (2021-22) reduces transaction costs for low-value UPI payments.

Q: Why is UPI popular in India?

A: Because it is fast, secure, and free of additional charges like MDR or GST.

Why Is This Important for Exams?

UPI & Digital India is a key topic in UPSC, SSC, PSC, and banking exams.

Understanding GST policies helps in economics and current affairs sections.

Government schemes like the UPI Incentive Scheme are often asked in competitive tests.

Get 3 Months Free Access for SSC, PSC, NIFT & NID

Boost your exam prep!

Use offer code WELCOME28 to get 3 months free subscription. Start preparing today!