Translate Language

How Do the Latest EU Sanctions Affect Russian Oil & India’s Refineries?

The European Union has intensified economic pressure on Russia with its 18th sanctions package, focusing on crippling Moscow’s oil revenues and financial networks. These measures include stricter price caps, expanded shipping bans, and new financial restrictions—directly affecting global trade dynamics, including India’s energy sector.

What Are the New Sanctions Against Russia?

The latest EU sanctions aim to weaken Russia’s ability to fund its war efforts while minimizing disruptions to global energy markets. Here’s what’s new:

1. Stricter Price Cap on Russian Oil

The EU has imposed a moving price ceiling on Russian crude oil, set 15% below the average market rate (around $47.60 per barrel).

This replaces the previous $60 per barrel cap set by the G7 in 2022.

The new rule takes effect from 3 September 2024, with a 90-day transition period for existing contracts.

EU companies cannot ship or insure Russian oil sold above this price.

2. Ban on Russian Petroleum Imports

After a six-month grace period, the EU will stop importing petroleum products made from Russian oil—even if refined in third countries.

Exceptions apply to imports from the US, UK, Canada, Norway, and Switzerland.

India’s Nayara Energy (partly owned by Russia’s Rosneft) faces restrictions, impacting its fuel supply chain.

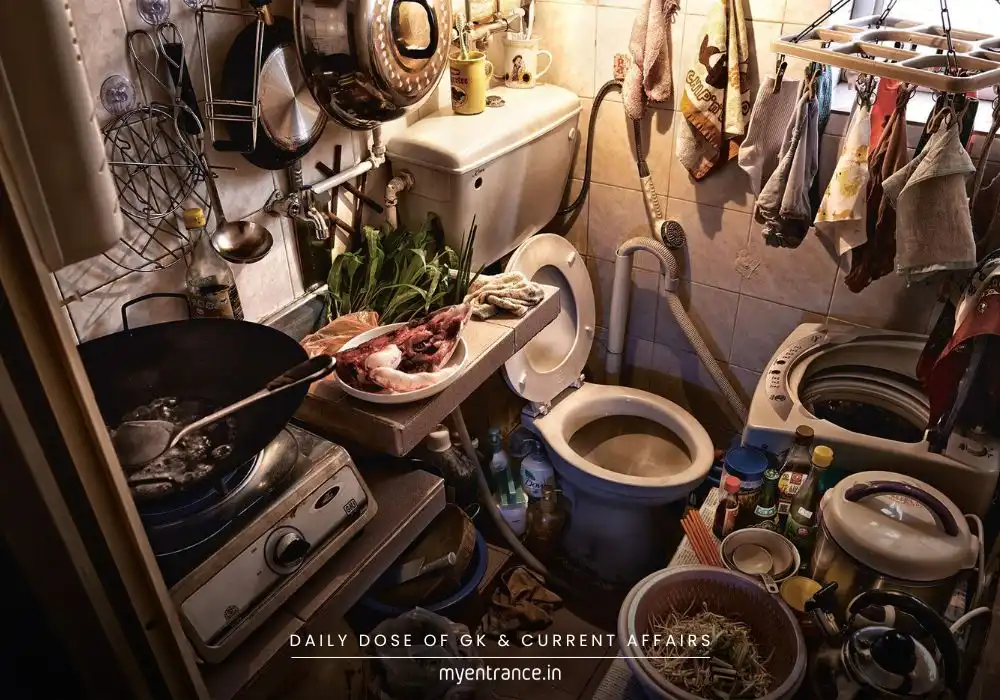

3. Crackdown on Russia’s Shadow Fleet

The EU has banned 105 additional ships from its ports to prevent illegal oil transfers.

These vessels, often old tankers, engage in ship-to-ship transfers to hide Russian oil origins.

The total number of blacklisted ships now exceeds 400.

4. Nord Stream Pipeline Ban

All transactions related to the Nord Stream gas pipelines are now prohibited.

This includes goods, services, and maintenance linked to the infrastructure.

5. Tougher Financial Restrictions

Expanded bans on transactions with Russian banks, including the Russian Direct Investment Fund (RDIF).

Lowered penalty thresholds for foreign entities helping Russia evade sanctions.

6. Export Controls & Expanded Blacklist

New bans on chemicals, plastics, and machinery exports to Russia.

26 additional entities (including firms in China, Hong Kong, and Turkey) added for sanctions evasion.

Questions & Answers for Competitive Exams

Q1. What is the new EU price cap on Russian crude oil?

Ans: $47.60 per barrel, 15% below the market average.

Q2. Which Indian refinery is affected by the EU’s latest sanctions?

Ans: Nayara Energy, partly owned by Russia’s Rosneft.

Q3. How many ships has the EU banned in its latest sanctions package?

Ans: 105 additional ships, bringing the total to over 400.

Q4. What is the main purpose of the EU’s oil price cap?

Ans: To reduce Russia’s oil revenue without disrupting global supply.

Q5. Which Russian financial entity was targeted in the new sanctions?

Ans: The Russian Direct Investment Fund (RDIF).

Why Is This Important for Competitive Exams?

UPSC/SSC/PSC: Questions on international relations, economic sanctions, and global trade frequently appear.

KAS/NID/NIFT: Current affairs on geopolitical conflicts and energy policies are crucial.

Banking & Insurance Exams: Financial sanctions and SWIFT restrictions are key topics.

Understanding these sanctions helps aspirants grasp global economic shifts and their impact on India—essential for essays, MCQs, and interviews.

Get 3 Months Free Access for SSC, PSC, NIFT & NID

Boost your exam prep!

Use offer code WELCOME28 to get 3 months free subscription. Start preparing today!